I mean, really. What if that thing flies loose talking to Angela Merkel or something?

Obama will be fine. He gives a good speech, and he’s for change I can believe in. Plus, he’s so totally not a socialist.

You might also like:

- Obama and the challenges of presidential rhetoric

There is so much to say about the recent S&P downgrade of the United States’ creditworthiness, a… - Vital information inexcusably omitted from inauguration coverage

For those of you awakening from a coma, or a three-month bourbon- and blow-fueled bender for that ma… - Obama selects 35-year Senate veteran for “change”

Apparently finding him an articulate, bright, clean, and nice-looking enough African-American, Senat… - Newt in Huntsville

A familiar-looking group of subversive right-winger types and I set out for the U.S. Space and Rocke… - Leaving folks to their nonsense

I was considering the other day how much less I care now when someone shares ridiculous nonsense of …

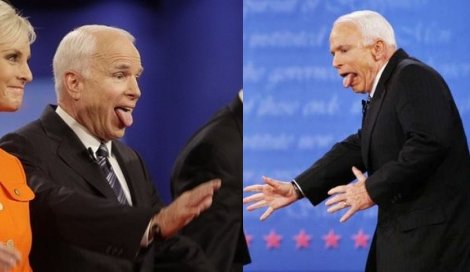

You know, it’s possible to get terrible pictures of ANYONE, especially with the cameras that take a zillion shots a second. Still, those pictures do make him look like a troll.

I’m so sorry, but I’m going to (continue to) respectfully disagree about Obama and socialism. I see where you’re getting it, but I also remember a little piece of the preamble to the Constitution where the Founders decided that one of the primary purposes of government is “to promote the general welfare.” I think that the idea of “spreading the wealth,” at least as I understand Obama to be promoting it, is more an act of compassionate governance than socialism. Besides, lifting up one generation may mean that the subsequent ones don’t need to be lifted at all, and that’s good for the future of the country, don’t you agree?

Mrs. Chili: How is a government “(promoting) the general welfare” when it punishes the achievements of its wealthiest citizens?

I would ask you the same question I asked Gerry. In 2005, the wealthiest 1% paid more than a third of all federal income taxes. The wealthiest 5% paid more than half. The wealthiest 25% paid 83.6%. The top half paid 96.4% of all federal income taxes.

Gerry called it “helping ordinary people”; you’re saying “compassionate governance” and “lifting up.” Keeping in mind that millions of people already pay no federal income tax at all, and also keeping in mind that the wealthiest among us already pay a hugely disproportionate amount of federal income tax: how much more “compassionate” can the government be? How much more “lifting up” needs to happen here?

Given where we are, and the fact that you say you still want more, where is your upper limit? How much more does it take to get to what you want?

Should we essentially remove the federal tax burden for the bottom 75%, rather than the bottom 50% it is today? Hey, let’s just cap incomes at $250,000, and everything above that is taxed at 100%. Good idea, or bad?

Where does it stop? How much is enough?

We ARE promoting the general welfare by allowing 40 percent of the working population to pay ZERO income tax. I guess you don’t understand the principle that when you pay no taxes, you really have little or no stake in how the government spends our tax money.

What don’t you understand about the concept that if “rich” people are taxed heavily they will find ways to not pay that tax. If you research this concept historically, you will find that Obama is just fooling himself by thinking that he will get more tax revenue by raising the marginal rate for the top 5 percent.

We are promoting the general welfare with food stamps, section 8 housing, SCHIP, free medical care, LIHEAP free heating oil, education grants, etc, etc.

I agree with Bo. Less government is better. The Greatest Generation

believed in hard work. Each generation seems to have embraced more government and more entitlements.

I listened to Powell’s announcement. I don’t buy a thing he says. I think it’s all about getting a black President. I base this conclusion on a number of statements he has made over the last few months. Powell is still suffering from a Vietnam stigma. He’s a weak leader who was a good fit for the state dept. where they talk a

lot and accomplish very little. Powell has always impressed me as one of those executives who is more interested in polishing his resume than accomplishing anything.

Mrs. Chili, please read Federalist No. 41 — written by no less authority than the man called the “Father of the Constitution” — concerning the meaning and function of the phrase “general welfare” in that instrument.

Yes, I have the temerity to come back after a bit of trollery.

I think the day is pretty far in the past when fretting about “isms” has much value. Hey, that’s just me.

Judging whether an idea has merit is not easy, but it certainly cannot be done by setting up largely semantic filters.

I’m with mrschili.

Pearl: I don’t have a strong opinion on Powell’s endorsement of Obama per se, though I’m not surprised he made it. Perhaps if Republicans had kept a little more closely to what they say they believe in (particularly fiscally) over the past decade, he’d have felt a little more loyalty.

Gerry: I have presented a breakdown by income level of federal taxes paid that shows that not only do “the wealthy” pay “their fair share,” they are the only ones paying anything. Obama wants more.

Greg has offered a link to Federalist No. 41. You and Mrs. Chili both have offered “promote the general welfare” in the preamble of the U.S. Constitution as allowing for this further redistribution of wealth.

Begging your pardon, but dismissing these points as “largely semantic,” particularly in the absence of any counter more substantive than “that’s just me,” is of rather limited persuasive value.

I would really like to understand the source of these tax revenue figures. I spent some time on irs.gov today and I found lots of 2005/2006 figures, but I didn’t find this breakdown. BUT there are hundreds of different ways to look at the data, and I wasn’t convinced that even if I put in the time, I would draw the correct conclusions. Do you have any links where it’s summarized? I don’t see how this can possibly be correct, just really doesn’t seem to add up.

Melanie: I know–it’s amazing to hear, but it’s true.

The source I used was a 2005 document from the U.S. Treasury:

http://treas.gov/press/releases/reports/factsheetwhopaysmostindividualincometaxes.update.pdf

I believe a person can make a rational argument for graduated tax rates on the basis that wealthier folks benefit more from government provided infrastucture (e.g. interstate highways, fair trade enforcement, etc…) than poorer folks. I’d even concede (although not necessarily agree) that wealthier folks should pay a higher percentage amount as well as a higher dollar amount for those services. However, when you start advocating the use of confiscatory tax policy to redistribute wealth on the basis of “spreading it around”, that is full blown SOCIALISM. No semantics involved!

I was going to leave another comment, but it took on a life of its own and became a post. It’s here; I welcome polite, constructive feedback.

http://theinnerdoor.wordpress.com/2008/10/23/the-post-thats-disguised-as-a-comment/

Warmly,

Chili

ALL taxation is “confiscatory” and therefore socialistic. It’s money that goes into a common pool for common purposes. The question is not socialism vs. not socialism. The question is how much is appropriate, as Bo notes. It goes both ways though. For people who always want lower taxes, how much is just enough? I’m guessing it’s always “less than right now”, no matter where we stand at any given time. Obama plans to bring us back to the levels we were at in the 90s, which is not a tax hike, but an on-schedule expiration of tax cuts enacted in the early 00s. NOBODY was crying “socialism” in the 90s. And the economy did just fine.

People were crying in the 90’s (probably not using the S word), but does anyone remember Hillary-Care and the uproar?